guide

Financial Risks Every Business Owner Needs to Know About

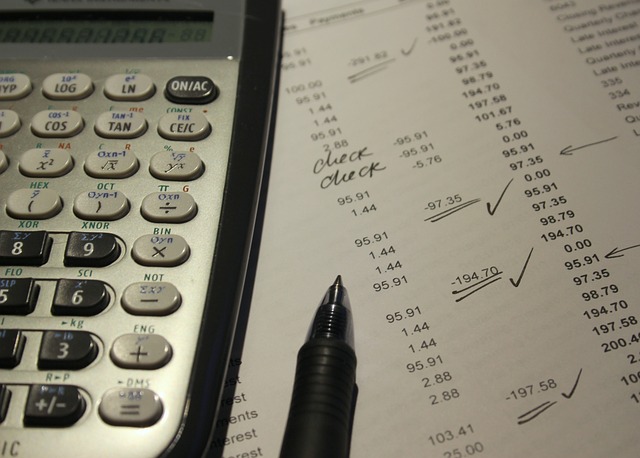

Running a business involves navigating a complex landscape of financial risks. Understanding these risks is crucial for maintaining financial stability and achieving long-term success. From market fluctuations to operational challenges, various factors can impact a company’s financial health. Here, we explore key financial risks every business owner needs to know about and how to mitigate them.

Market Risk

Market risk refers to the potential for financial loss due to changes in market conditions, such as fluctuations in demand, price volatility, and economic downturns. This risk can affect revenues, profits, and the overall value of the business. For instance, a sudden drop in consumer demand for a company’s products can lead to reduced sales and profitability. To mitigate market risk, business owners should diversify their product or service offerings, stay informed about market trends, and develop strategies to adapt to changing conditions.

Credit Risk

Credit risk arises from the possibility that customers or clients will default on their payments, leading to cash flow issues and potential financial losses. This risk is particularly relevant for businesses that extend credit to their customers. To manage credit risk, business owners should establish clear credit policies, conduct thorough credit checks on new customers, and monitor outstanding receivables closely. Implementing a robust credit control system and setting credit limits can also help minimize the risk of non-payment.

Operational Risk

Operational risk encompasses the potential for financial loss due to internal failures, such as inadequate processes, systems, or human errors. This risk can result from a wide range of factors, including supply chain disruptions, equipment breakdowns, or cybersecurity breaches. To reduce operational risk, businesses should invest in efficient systems and technologies, train employees thoroughly, and establish comprehensive operational procedures. Regular audits and risk assessments can help identify vulnerabilities and ensure that appropriate controls are in place.

Financial Reporting Risk

Financial reporting risk refers to the possibility of inaccuracies in financial statements, which can lead to poor decision-making, regulatory penalties, and loss of investor confidence. This risk can arise from errors in data entry, misinterpretation of accounting standards, or fraud. To mitigate financial reporting risk, businesses should implement strong internal controls, conduct regular financial audits, and ensure that accounting personnel are well-trained and knowledgeable about current accounting standards. Utilizing reliable accounting software can also help improve the accuracy and integrity of financial reporting.

Liquidity Risk

Liquidity risk is the risk that a business will not be able to meet its short-term financial obligations due to a lack of sufficient cash flow. This can occur when there are delays in receiving payments from customers or unexpected expenses arise. To manage liquidity risk, business owners should closely monitor cash flow, maintain an emergency fund, and establish lines of credit or other financing options. Regularly reviewing financial statements and forecasts can help identify potential liquidity issues and allow for proactive management of cash flow.

Interest Rate Risk

Interest rate risk arises from fluctuations in interest rates that can affect a company’s borrowing costs and investment returns. For businesses with variable-rate loans, rising interest rates can lead to higher debt servicing costs, while falling rates can reduce investment income. To manage interest rate risk, business owners can consider fixed-rate loans, use interest rate hedging instruments, and regularly review their debt portfolio. Additionally, maintaining a diversified investment strategy can help mitigate the impact of interest rate changes on overall financial performance.

Conclusion

Understanding and managing financial risks is essential for the stability and growth of any business. By recognizing the various types of financial risks, business owners can take proactive steps to mitigate their impact. Implementing robust risk management strategies, maintaining financial discipline, and staying informed about market and regulatory changes are crucial for navigating the complex landscape of business risks. With careful planning and diligent management, business owners can protect their financial health and ensure long-term success.…

Tips When Taking Out Motorcycle Loans

When it comes to taking out a motorcycle loan, there are a few things you need to keep in mind. This is very important because a motorcycle loan is a big purchase, and you want to make sure that you can afford it. Many people think they can go to a dealership, pick out a bike, and then finance it. This is not as easy as it sounds, and you need to be prepared before you even step foot into a dealership. If you want to learn more about motorcycle title loans, you should keep on reading. Here are some tips when taking out motorcycle loans.

Consider Your Credit Score

Your credit score is one of the essential factors in getting a good interest rate. If you have a high credit score, you’re more likely to get a lower interest rate. This is very important because it can save you thousands of dollars over the life of your loan. It would be best if you had a good credit score when taking out a motorcycle loan.

Your credit score is one of the essential factors in getting a good interest rate. If you have a high credit score, you’re more likely to get a lower interest rate. This is very important because it can save you thousands of dollars over the life of your loan. It would be best if you had a good credit score when taking out a motorcycle loan.

Aside from that, a good credit score will also let you be qualified for other perks like cashback or rewards points.

Get a Pre-Approved Loan

If you have a good credit score, you should be able to get a pre-approved loan. This means that you’ll know how much money you can borrow before you even start shopping for a motorcycle. This can be a great way to stay within your budget. It’s also a good idea to get pre-approved for a loan before you go to the dealership. This way, you won’t be tempted to spend more than you can afford. It is why many people recommend getting a pre-approved loan.

Compare the Interest Rates

When you’re looking for a loan, it’s important to compare interest rates. You can do this by going online and comparing rates from different lenders. This is the best way to ensure you get the best deal possible. Be sure to compare both fixed and variable interest rates. You should also compare the loan terms, such as the length of the loan and the monthly payments. Many people think that it is not important to compare interest rates, but it can save you a lot of money in the long run. If you’re in the market for a motorcycle loan, there are some things you can do to make sure you get the best deal possible.

When you’re looking for a loan, it’s important to compare interest rates. You can do this by going online and comparing rates from different lenders. This is the best way to ensure you get the best deal possible. Be sure to compare both fixed and variable interest rates. You should also compare the loan terms, such as the length of the loan and the monthly payments. Many people think that it is not important to compare interest rates, but it can save you a lot of money in the long run. If you’re in the market for a motorcycle loan, there are some things you can do to make sure you get the best deal possible.

By following these tips, you can minimize your interest payments and save money over the life of your loan. So what are you waiting for? Start shopping around for the best motorcycle loans today. We hope that you find this blog post helpful.…