Author: Desmond Charles

Financial Risks Every Business Owner Needs to Know About

Running a business involves navigating a complex landscape of financial risks. Understanding these risks is crucial for maintaining financial stability and achieving long-term success. From market fluctuations to operational challenges, various factors can impact a company’s financial health. Here, we explore key financial risks every business owner needs to know about and how to mitigate them.

Market Risk

Market risk refers to the potential for financial loss due to changes in market conditions, such as fluctuations in demand, price volatility, and economic downturns. This risk can affect revenues, profits, and the overall value of the business. For instance, a sudden drop in consumer demand for a company’s products can lead to reduced sales and profitability. To mitigate market risk, business owners should diversify their product or service offerings, stay informed about market trends, and develop strategies to adapt to changing conditions.

Credit Risk

Credit risk arises from the possibility that customers or clients will default on their payments, leading to cash flow issues and potential financial losses. This risk is particularly relevant for businesses that extend credit to their customers. To manage credit risk, business owners should establish clear credit policies, conduct thorough credit checks on new customers, and monitor outstanding receivables closely. Implementing a robust credit control system and setting credit limits can also help minimize the risk of non-payment.

Operational Risk

Operational risk encompasses the potential for financial loss due to internal failures, such as inadequate processes, systems, or human errors. This risk can result from a wide range of factors, including supply chain disruptions, equipment breakdowns, or cybersecurity breaches. To reduce operational risk, businesses should invest in efficient systems and technologies, train employees thoroughly, and establish comprehensive operational procedures. Regular audits and risk assessments can help identify vulnerabilities and ensure that appropriate controls are in place.

Financial Reporting Risk

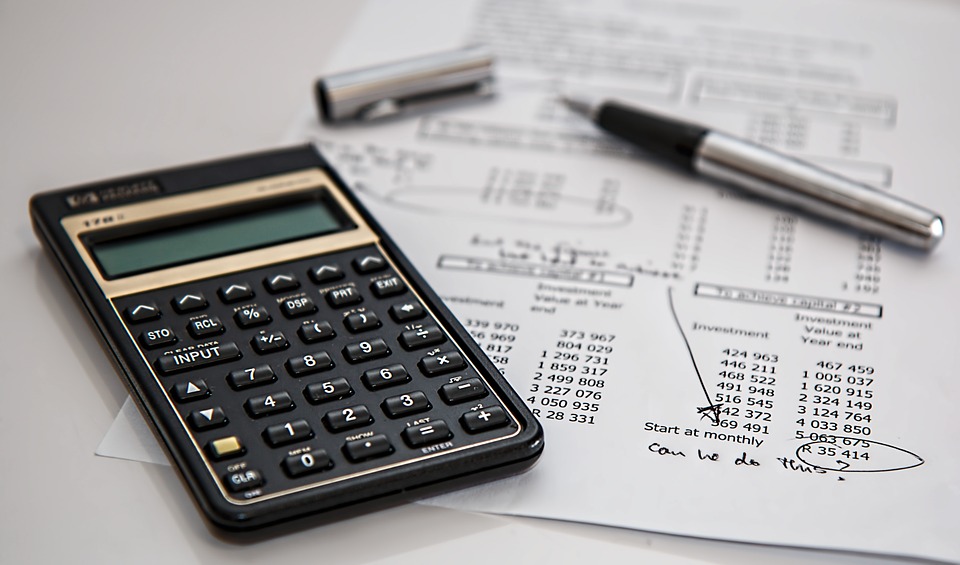

Financial reporting risk refers to the possibility of inaccuracies in financial statements, which can lead to poor decision-making, regulatory penalties, and loss of investor confidence. This risk can arise from errors in data entry, misinterpretation of accounting standards, or fraud. To mitigate financial reporting risk, businesses should implement strong internal controls, conduct regular financial audits, and ensure that accounting personnel are well-trained and knowledgeable about current accounting standards. Utilizing reliable accounting software can also help improve the accuracy and integrity of financial reporting.

Liquidity Risk

Liquidity risk is the risk that a business will not be able to meet its short-term financial obligations due to a lack of sufficient cash flow. This can occur when there are delays in receiving payments from customers or unexpected expenses arise. To manage liquidity risk, business owners should closely monitor cash flow, maintain an emergency fund, and establish lines of credit or other financing options. Regularly reviewing financial statements and forecasts can help identify potential liquidity issues and allow for proactive management of cash flow.

Interest Rate Risk

Interest rate risk arises from fluctuations in interest rates that can affect a company’s borrowing costs and investment returns. For businesses with variable-rate loans, rising interest rates can lead to higher debt servicing costs, while falling rates can reduce investment income. To manage interest rate risk, business owners can consider fixed-rate loans, use interest rate hedging instruments, and regularly review their debt portfolio. Additionally, maintaining a diversified investment strategy can help mitigate the impact of interest rate changes on overall financial performance.

Conclusion

Understanding and managing financial risks is essential for the stability and growth of any business. By recognizing the various types of financial risks, business owners can take proactive steps to mitigate their impact. Implementing robust risk management strategies, maintaining financial discipline, and staying informed about market and regulatory changes are crucial for navigating the complex landscape of business risks. With careful planning and diligent management, business owners can protect their financial health and ensure long-term success.…

Key Factors to Financial Sustainability of a Company

Running a business is not easy. In fact, it can be pretty concerning to maintain financial sustainability. It’s a key to the longevity of any company. To learn more about how financial planning can make or break a company. But many factors go into making a company successful, and if you neglect any of them, your business could suffer. That’s why today, we’ll talk about the critical factors to financial sustainability and how you can ensure that your company is on solid ground. Let’s get started.

Financial and Strategic Planning

The first key aspect of financial sustainability is planning. You need a clear idea of where your money is going and your long-term goals. It means creating a budget and sticking to it. It also means setting aside money for unexpected expenses, like repairs or legal fees. Making ends meet and keeping your business afloat will be difficult without a plan.

The first key aspect of financial sustainability is planning. You need a clear idea of where your money is going and your long-term goals. It means creating a budget and sticking to it. It also means setting aside money for unexpected expenses, like repairs or legal fees. Making ends meet and keeping your business afloat will be difficult without a plan.

Income Diversification

When it comes to financial sustainability, income diversification is vital. That means having more than one source of income. You’re putting all your eggs in one basket if you rely on just one revenue stream. And if that income dries up, you could be in serious trouble. Diversifying your income gives you a safety net and can help keep your business afloat during tough times. Therefore, it’s essential to consider different ways to make money. For example, you could offer services or products, rent out space, or invest in real estate.

Good Administration and Finance

Since we’re on financial sustainability, good administration and finance are worth mentioning. This refers to managing your money and keeping track of your finances. It’s important to have a system in place that works for you and your business. This could include using accounting software, hiring a bookkeeper, or working with a financial advisor. Good administration and finance practices will help you make better decisions with your money and keep your business on track.

Own Income Generation

Ultimately, one of the most important factors to financial sustainability is generating your own income. It means having a steady stream of revenue that you can rely on. It could come from sales, investments, or other sources. Having your own income gives you the security and flexibility to weather any storm. It’s one of the best ways to ensure financial sustainability and keep your business afloat.

Ultimately, one of the most important factors to financial sustainability is generating your own income. It means having a steady stream of revenue that you can rely on. It could come from sales, investments, or other sources. Having your own income gives you the security and flexibility to weather any storm. It’s one of the best ways to ensure financial sustainability and keep your business afloat.

If you focus on these critical points, you’ll be well on your way to keeping your business afloat. So don’t neglect any aspect of your finances. Plan ahead, diversify your income and keep good administration and finance practices in place. And most importantly, make sure you’re generating your own income. Do all of this, and you’ll be on your way to a financially sustainable business.…

Tips When Taking Out Motorcycle Loans

When it comes to taking out a motorcycle loan, there are a few things you need to keep in mind. This is very important because a motorcycle loan is a big purchase, and you want to make sure that you can afford it. Many people think they can go to a dealership, pick out a bike, and then finance it. This is not as easy as it sounds, and you need to be prepared before you even step foot into a dealership. If you want to learn more about motorcycle title loans, you should keep on reading. Here are some tips when taking out motorcycle loans.

Consider Your Credit Score

Your credit score is one of the essential factors in getting a good interest rate. If you have a high credit score, you’re more likely to get a lower interest rate. This is very important because it can save you thousands of dollars over the life of your loan. It would be best if you had a good credit score when taking out a motorcycle loan.

Your credit score is one of the essential factors in getting a good interest rate. If you have a high credit score, you’re more likely to get a lower interest rate. This is very important because it can save you thousands of dollars over the life of your loan. It would be best if you had a good credit score when taking out a motorcycle loan.

Aside from that, a good credit score will also let you be qualified for other perks like cashback or rewards points.

Get a Pre-Approved Loan

If you have a good credit score, you should be able to get a pre-approved loan. This means that you’ll know how much money you can borrow before you even start shopping for a motorcycle. This can be a great way to stay within your budget. It’s also a good idea to get pre-approved for a loan before you go to the dealership. This way, you won’t be tempted to spend more than you can afford. It is why many people recommend getting a pre-approved loan.

Compare the Interest Rates

When you’re looking for a loan, it’s important to compare interest rates. You can do this by going online and comparing rates from different lenders. This is the best way to ensure you get the best deal possible. Be sure to compare both fixed and variable interest rates. You should also compare the loan terms, such as the length of the loan and the monthly payments. Many people think that it is not important to compare interest rates, but it can save you a lot of money in the long run. If you’re in the market for a motorcycle loan, there are some things you can do to make sure you get the best deal possible.

When you’re looking for a loan, it’s important to compare interest rates. You can do this by going online and comparing rates from different lenders. This is the best way to ensure you get the best deal possible. Be sure to compare both fixed and variable interest rates. You should also compare the loan terms, such as the length of the loan and the monthly payments. Many people think that it is not important to compare interest rates, but it can save you a lot of money in the long run. If you’re in the market for a motorcycle loan, there are some things you can do to make sure you get the best deal possible.

By following these tips, you can minimize your interest payments and save money over the life of your loan. So what are you waiting for? Start shopping around for the best motorcycle loans today. We hope that you find this blog post helpful.…

3 Reasons You Should Hire an Accountant

If you’re a small business owner, one of the most important decisions you’ll make is whether or not to hire an accountant. Chartered Certified Accountants can help you save time and money and help improve your business’s bottom line. This blog post will discuss nine reasons why you should hire an accountant for your small business.

Eliminate Errors

One of the most important functions of an accountant is to eliminate errors in your financial statements. Small business owners often don’t have the time or expertise to catch all of the mistakes you can make in their financial statements. An accountant can help you avoid costly errors by reviewing your statements and catching any errors that have been created. An accountant can also help you save money on your taxes. They can help you take advantage of tax breaks and deductions that you may not be aware of. An accountant can also help you file your taxes quickly and efficiently.

One of the most important functions of an accountant is to eliminate errors in your financial statements. Small business owners often don’t have the time or expertise to catch all of the mistakes you can make in their financial statements. An accountant can help you avoid costly errors by reviewing your statements and catching any errors that have been created. An accountant can also help you save money on your taxes. They can help you take advantage of tax breaks and deductions that you may not be aware of. An accountant can also help you file your taxes quickly and efficiently.

Improve Business Funding Acceptance

Another reason to hire an accountant is to improve your chances of getting business funding. Banks and other lenders often require businesses to provide financial statements before approving a loan. An accountant can help you prepare these statements and make sure that they accurately reflect your business’s financial situation. This can help you get the funding you need to grow your business.

Better Business Decisions

An accountant can also help you make better business decisions. They can provide you with insights into your financial situation that you may not be aware of. They can also help you understand the tax implications of different business decisions. This knowledge can help you save money and make better decisions for your business. If you want your company to succeed, you need to ensure that its financial foundation is strong. An accountant can help you achieve this by providing you with the tools and knowledge to make sound financial decisions.

An accountant can also help you make better business decisions. They can provide you with insights into your financial situation that you may not be aware of. They can also help you understand the tax implications of different business decisions. This knowledge can help you save money and make better decisions for your business. If you want your company to succeed, you need to ensure that its financial foundation is strong. An accountant can help you achieve this by providing you with the tools and knowledge to make sound financial decisions.

Overall, an accountant can be a valuable asset to your small business. They can save you time and money and help you grow your business. If you’re not sure whether or not you need an accountant, consider these nine reasons you should hire one. You may be surprised at how much they can help your business.…

Factors to Consider When Getting Accounting Services

Some people might not think of accounting as the most adventurous job to have. However, it is a crucial component in just about any business or company. If you run a large firm or are just starting, it will help if you get accounting services. It saves you from doing the paperwork. Also, if you are not too good at math, it can be downright frustrating. The question then is, are there factors you need to consider? Here is all you need to know.

Qualifications and Experince

Always look at the academic certifications and qualifications of the accountant you want to go for. Whether hiring an entire firm to work for you or a sole accountant, do your research first. One major license is if they are Certified Public Accountants (CPAs). Another qualification you should check for is Certified Management Accountants (CMAs). It assures you that they know what they are doing and are up-to-date with the required standards.

Always look at the academic certifications and qualifications of the accountant you want to go for. Whether hiring an entire firm to work for you or a sole accountant, do your research first. One major license is if they are Certified Public Accountants (CPAs). Another qualification you should check for is Certified Management Accountants (CMAs). It assures you that they know what they are doing and are up-to-date with the required standards.

It does not hurt to go for a recently qualified accountant. However, it is a safer bet to go with a well-versed accounting service.

It is especially true if you handle complicated transactions. Qualified accounting services should be able to meet your expectations from basic bookkeeping to financial analysis.

Costs

Arguably, this is one of the most important factors to consider. Look at how much the accounting service will charge you. Also, consider if they have any special perks. For instance, some accounting services can offer you discounted prices for an undertaking of regular work. Also, consider the complexity and quantity of accounting work you need to do while negotiating fees.

Accessibility

Go for accounting services that you can access whenever you need them. Whether you go for a small firm of accountants or just one- it should not be too hard to get a hold of your accountant.

In line with this, it helps if you have a cordial relationship with the accounting service you choose. This sort of collaboration might be what your business needs to thrive. Ensure the accountant knows all your goals and work with them to meet them on the accounting front.

These are the things you have to consider when getting accounting services. Look at their experience, billing, availability, and qualifications. Also, nothing beats the good old way of knowing commendable services- by word of mouth. Ask around for referrals and have these tips in mind.…

The Top 4 Benefits of Homeowner Insurance

Homeowner insurance is often underappreciated because people think that their house is safe because they have already paid off the mortgage. Well, what happens if there is a gas leak in the house that causes a fire? Or a leaky pipe that flooded the entire house? Houses are liable to many risks, and it certainly requires insurance to protect them financially. If you want to find out about the Top 5 Home Owners Insurance Companies, please click the link to visit the article.

Why did I say underappreciated? Because that is not the only benefit of getting homeowner insurance. Let’s check them out below:

It Covers Many Things

Your typical homeowner insurance will protect your house and cover all of its expenses in the event that it is damaged or destroyed. But what people don’t know is that homeowner insurance covers many things besides the house itself, like dwelling coverage, structure coverage, personal property coverage, guest medical protection, living expenses, and personal liability. This makes having homeowner insurance all the more reassuring!

It Protects You from Spending Money on Repairs

A homeowner insurance will shield you financially from exerting hundreds or even thousands of dollars on reparations or rebuilding the building. This is not only limited to manmade disasters like leaking pipe or gas fire, but it can also cover you financially in the event of force majeures like earthquake, landslide, flood, tornado, etc.

It Protects You from Lawsuits

Let’s talk about the possibility that when you are having a visitor or guest coming by or even spending the night at your residence, suddenly an unexpected event unfolds like structure failure that causes the ceiling to collapse on your visiting guest. They are injured by your property and are injured on your property; this means you are responsible for their medical bills. There’s also the lingering possibility that they could sue you for their injuries and pain that they are suffering. Not to worry, if you have homeowner insurance, it can cover both personal liability and your guest’s medical bills.

It Helps You Not to Stress on the Small Things

Life is already challenging; you have work, chores, and errands to run, not to mention all the stress and anxiety building up in fear of your house being robbed or catch on fire. Imagine the financial loss you would have to endure in the event of such tragedies happening, and it would be both catastrophic and heart-breaking. Still, if you have homeowner’s insurance, then you can sleep soundly at night without constantly thinking of the bad scenarios that could happen.

Hopefully, after reading these benefits, you are enlightened and convinced that homeowner insurance is necessary. Remember that it doesn’t matter if you are looking for a new place to buy or you’ve just paid the mortgage. Having your home insured is unquestionably a must!…

Simple Tips to Consider When Looking for an Accountant

Have you been wondering where all the money you or your business makes has been disappearing to? If so, you are not alone. Many people, especially business owners, do not keep a proper record of their cash flow. And this is one of the reasons why they do not know whether they are making more money or less.

The good news is there are competent accountants out there you can trust with the job. You can use the internet to find them, which will take you less than a minute, but before you select any of those that you see on the internet, written below is what you need to consider if you want to pick the best from the many that you will find.

Government Certification

The first and most important thing you need to consider before hiring someone to manage or even take a look at your finances is government certification. Money is sensitive, and you need someone who you can easily trace. An excellent accountant must have a license and should belong to a known group or firm of accountants.

Qualification

The next important point you need to look at is the qualifications. You need a financial advisor who has qualified and certified from a well-known accounting institution. To start with, you can ask about the institution the accountant you want to hire graduated from then do your research about the same. As said, early money is sensitive, and you have to be very careful when selecting someone for this job.

Firm

The other thing you should consider when hiring an accountant is the firm they work with. Try not to hire a solo freelance because you cannot be guaranteed to find them whenever you have problems with your accounts. An excellent firm should also have a physical office and a customer care desk that you can contact. Also, when working with someone from a known accounting firm, you are guaranteed to get the best services.

Experience

Last but certainly not least is the experience. If you want the best services, then you need to find an experienced accountant. Guess the question in your mind is how to know if a person is experienced, right? This is easy. You can know that you are working with an experienced accountant by simply inquiring about the number of years someone has been actively practicing.…

What is the Importance of Financial Statements for a Company?

When any person wants to know about the financial health of a business, they go through their financial statements. The statements are prepared from the daily bookkeeping that captures the company’s inflow and outflow of funds. The information in the financial statements helps to benchmark the business and provide information that enables the relevant persons to adjust and come up with the company’s overall direction.

Other people outside the company rely on the financial statement to judge the business’s performance. The government depends on the financial statements referred to as statutory accounts to compute a company’s tax liability. T

Making Informed Decisions

During decision making, it is necessary to analyze financial statements. For example, when deciding if to expand the company, the decision-makers will look through the financial statements. The idea is to see how much debt the business has, the amount of the shareholders’ capital, and how much liabilities the company has. From the information, they can decide on the affordable or most appropriate form of financing to seek.

During decision making, it is necessary to analyze financial statements. For example, when deciding if to expand the company, the decision-makers will look through the financial statements. The idea is to see how much debt the business has, the amount of the shareholders’ capital, and how much liabilities the company has. From the information, they can decide on the affordable or most appropriate form of financing to seek.

Evaluating Tax Liability

One of the hugest burdens that businesses have to shoulder is the corporate tax. Most business owners are surprised that they have so little cash left after paying tax to the government. They are interested to know if there are ways in which they can reduce their tax liability.

One of the hugest burdens that businesses have to shoulder is the corporate tax. Most business owners are surprised that they have so little cash left after paying tax to the government. They are interested to know if there are ways in which they can reduce their tax liability.

To decrease their tax burden, they will need to prepare or seek assistance to make accurate financial statements. The government’s perception is that most businesses cook their books to avoid paying tax or reduce their tax payable. So to get any tax allowance, or to pay the correct tax amount, accurate financial statements are necessary.

Building Trust

Accurate financial statements are critical for inducing trust in the business. Various stakeholders need to be assured that the company is stable and doing well. This can be seen from the financial statements. For example, investors are interested in knowing how the business is performing to decide if they will inject their hard-earned cash into the business. Lenders need to be sure the business is stable to approve it for credit facilities. Employees also need to know how the company is faring, and this through the statements. The reason for this is to be sure that their jobs are not at risk.…

Tips on Using Your Credit Card Wisely

Using your credit card wisely can help you to save money. It can also help you to increase your credit score by using a credit card responsibly. There are different types of credit cards, and it is important to choose the right card for you.

Credit cards can be useful in budgeting and also learning how to spend money wisely. When it comes to using cabelas visa credit card, make sure that you form habits that will guarantee you responsible use. Here are some tips to help you to choose your credit card responsibly:

Start By Choosing the Right Credit Card

The first step is to choose the right credit card. You need to choose a credit card that is ideal for your needs. A good credit card should be one that will match your spending habits. When you have a good credit card, you can save money and at the same time get discounts.

The first step is to choose the right credit card. You need to choose a credit card that is ideal for your needs. A good credit card should be one that will match your spending habits. When you have a good credit card, you can save money and at the same time get discounts.

Choose one that has low fees so that you can save money. You can always compare rates between different companies to determine the right choice for you. We have credit cards that are made for students, shopping, and other needs depending on the use of the card.

Monitor Your Credit Card Transactions

Monitoring your transactions is the best thing that you can do for yourself. Make sure that you take time each month to see the transactions that you made through that month. Monitoring your spending will help you to determine how you spend your money.

This is also a good time to check the transactions that you did not authorize. With the rising cases of credit card theft, someone can still your identity and start using your money irresponsibly.

Pay Your Bills On Time

Paying your bills on time is the best gift that you can give yourself. Make sure that all the bills are paid on time so that you can increase your credit score. You need to understand that late payment can affect your credit rating significantly.

Always make sure that you pay bills on time by making the payments automatic. You can set automatic payments so that you do not have to forget about making your payments.

Come Up With A Budget

Coming up with a good budget is very important. You need to use your money responsibly, and a good budget can help you with that.

When you have a budget, you do not have to worry about going beyond your limit. Apart from coming up with a budget, make sure that you stick to it.…

Why You Need a Financial Advisor

Managing your finances is not always easy. A good number of people today hire financial advisors. But with all manner of financial apps, retirement calculators, portfolio analyzers, you might be tempted to reconsider your decision to hire a financial advisor. Should you hire an investment advisor even after reading this article? This article looks at some common financial challenges, and the role played by investment advisors so that you can make an informed decision on whether to hire one or not.

Information Overload

With some money to spend, you will always be served with loads of information. As much as information is meant to empower us, information overload often makes most people susceptible to making costly financial decisions. Instead of making a poor investment, a financial advisor will always go through a variety of sources and help you choose the best. Thus, instead of falling for some sales pitch, always let professionals assess the situation for you.

Personal Biases

Managing your money or investments comes with its advantages and disadvantages. Most often than not, the decisions you make when working for yourself are always subject to some biases. You are also at risk of making some rash decisions. As a result, hiring a financial advisor will keep you safe from mistakes resulting from personal biases. Also, these professionals will hold your hand when things get tough by helping you make rational and informed decisions.

Time Factor

Lack of time to make some decision is also another reason to hire an investment planner. For instance, if you are always at your place of work, and you would want to start a business, getting ample time to assess the risks and opportunities involved can be challenging. Instead, hiring a financial planner can help you overcome the limitations that come with having little time. And if the financial advisor can free up some of your time, you will be able to concentrate more at work or have more time with your family.

Lack of time to make some decision is also another reason to hire an investment planner. For instance, if you are always at your place of work, and you would want to start a business, getting ample time to assess the risks and opportunities involved can be challenging. Instead, hiring a financial planner can help you overcome the limitations that come with having little time. And if the financial advisor can free up some of your time, you will be able to concentrate more at work or have more time with your family.

There are many reasons why you might need the services of a financial planner. Anyone can hire a financial or investment planner. You do not have to be having lots of money or a huge investment to hire investment advisors; you can have them help you grow your investment. Anyone keen on making financially sound decisions, then hiring an investment planner is a decision worth considering.…

The Importance of Hiring a Corporate Trustee

It has been a common view these days that companies need external help to manage their assets. One of the most apparent reasons is that the company owners do not trust their internal management so that they need other parties to handle the matter. These external parties must at least possess several qualities, and they include professionalism, reliability, and experience. Of course, one will not risk all the assets by choosing a company that is not reliable or experienced. For that reason, it becomes clear that trust companies are growing in demand as there are many new growing and struggling companies in certain fields.

The term corporate trustee simply refers to a professional institution or corporation. One fundamental benefit of hiring such corporations is that it is not a privately-funded company, making it a fair and neutral party to manage the assets. In many cases, people often have a hard time deciding whether or not they have made the right choices by giving the access to their assets to certain people instead of an institution, and eliminating such concerns is one of the corporation’s goals.

Experience

Experience often comes with professionalism, and it has to be present before a company owner hires their service. A trustee serves to secure, manage, and handle all the matters related to the assets and how it is used to retain its value. For this reason, a trustee company needs to at least possess the ability to understand the latest market trends to know how to handle the assets. Their experience is something that certain individuals do not have, making it an excellent choice to give the owners peace of mind.

Objectivity

Rather than relying on one’s subjectivity, a corporate trustee can be so firm when it comes to executing the plans and the contracts. Everything is no longer an individual discussion, but rather a professional matter where mistakes can lead to lawsuits. For this reason, it is safe to conclude that safety that results from objectivity is one strong aspect that a company owner can depend on. They carry out certain tasks as stated in the contract, and they also act as a supervisor who can detect any signs of malpractice.

Rather than relying on one’s subjectivity, a corporate trustee can be so firm when it comes to executing the plans and the contracts. Everything is no longer an individual discussion, but rather a professional matter where mistakes can lead to lawsuits. For this reason, it is safe to conclude that safety that results from objectivity is one strong aspect that a company owner can depend on. They carry out certain tasks as stated in the contract, and they also act as a supervisor who can detect any signs of malpractice.

Long-Term Services

One reason why hiring a corporation is a better option than handing all the assets to a family member is that the company will make sure they will give you their services as long as the contract is not terminated. Personal and private discords are something that you will never find as they try to keep things professional.…

Top Reasons You Should Get Pre-Approved for a Mortgage

If you are planning to buy a home, the chances are that you are planning to get a mortgage to finance your move. There are many things to do to make this process successful. You might be required to look for a real estate agent, come up with a budget, and most importantly, get pre-approved for a mortgage. If you are on the line on whether you need a pre-approval or not, here are some reasons to make this move.

Sellers Take You Seriously

When you are ready to place your offer for a home, the seller or the estate agent you are dealing with would like some sought of assurance that you are a serious buyer. A mortgage pre-approval acts as an assurance from the lender about their willingness to offer you a certain amount of money if you need to buy property.

Makes Budgeting Easy

How much is the seller willing to give you? The best way to know this is to be pre-approved for a mortgage. The essence of going for mortgage pre-approval is to get a rough estimate of the amount you are likely to get from the lender. With an idea of what the lender has to offer, it becomes a lot easy for you to make a budget. Besides just knowing the amount you can raise, getting pre-approved gives to an opportunity to plan more about your mortgage payments.

Simple

Another attraction towards being pre-approved for a mortgage is the simplicity of the process. As such, you should not be worried about a lengthy process such as those subjected to loan borrowers. Even better, a pre-approval does not tie you to working with a particular lender. But it does simplify your property hunt.

Makes Negotiations Easy

So you have managed to locate some potential property, you might be looking for any possible way to get a decent deal. A pre-approval gives you a solid ground to initiate negotiations based on the amount of money that you have. A pre-approval letter from a lender improves your bargaining power, thus making negotiations a lot easy for you.

So you have managed to locate some potential property, you might be looking for any possible way to get a decent deal. A pre-approval gives you a solid ground to initiate negotiations based on the amount of money that you have. A pre-approval letter from a lender improves your bargaining power, thus making negotiations a lot easy for you.

Getting pre-approved for a mortgage is good in many ways. Nothing beats working with the best lender.…

Top Tips to Get Your Loan Approved

When you are facing a financial emergency, getting a loan fast should be your primary concern. Unfortunately, there are times when this takes abnormally long, which can be quite stressful. You might need some money to pay for your auto insurance, home renovations, or paying some tuition fees. Before you start looking for a loan, here are some important tips that will help you improve your chances of getting approved or the loan.

Choose the Right Loan

The first step in any loan application process is to know the nature of the loan you need. The nature of your financial needs often informs this. If you need a loan to buy a house, a mortgage can be a better option. On the other hand, if you need a loan to help you cater for some general financial obligations, consider a personal loan. As a tip, joustoluotto or flexible credit loans are ideal, especially when you are not so sure of how you will pay your mortgage.

Work on Your Credit Score

If you are happy with your credit score, this point should not worry you much. But if you are like most people who do not have an excellent credit score, it is advisable to work on your credit score. A healthy credit score not only improves your chances of getting the loan, but it also qualifies you for a better interest rate.

Borrow Within Your Means

Only borrow what you are convinced you will be able to pay. As such, this requires you to assess your financial situation objectively. Borrowing more than you need is like shooting yourself on your foot. As much as the lender might encourage you to get more, only go for what you need to avoid entangling yourself in a cycle of debt. Also, borrowing a smaller amount improves your chances of getting the loan amount.

Get the Right Lender

There are many options to choose from when applying for a loan. Different lenders are known for different things; loan type, interest rates, and repayment periods. Thus, when applying for a loan, it is imperative to do some due diligence and see what different lenders have to offer. Well, it is highly likely that you will not get the perfect match for your needs, but you can always get a decent match.

There are many options to choose from when applying for a loan. Different lenders are known for different things; loan type, interest rates, and repayment periods. Thus, when applying for a loan, it is imperative to do some due diligence and see what different lenders have to offer. Well, it is highly likely that you will not get the perfect match for your needs, but you can always get a decent match.

Getting a loan can be the best thing you have ever done or a nightmare depending on how you approach this move. Thus, besides getting the money, proper planning is key.…

How to Avoid Overspending

Spending money is part and parcel of life, and must be embraced with dignity. What is meant by this statement is that you need a strategy that will see you through the worst financial difficulties ever to be faced.

Overspending is something that most of us have done at some point in our lives. Worse still, most of us are still in this snare, and are wondering how to make an impactful escape. No worries since there are plenty of ways in which you can tame your appetite for spending money. Most of them will require you to make huge sacrifices that you are not used to. On the bright side, they will pay off when you make a deliberate effort to be consistent.

Here are some tips on how to avoid overspending:

What You Need

One of the leading causes of overspending has got to be carrying money unnecessarily. For instance, if you are going to the grocery store, be sure to carry only what you need. Anything above this will only leave you crippled financially.

One of the leading causes of overspending has got to be carrying money unnecessarily. For instance, if you are going to the grocery store, be sure to carry only what you need. Anything above this will only leave you crippled financially.

This should be a habit and routine that you must learn to nurture. Do this by keeping your savings account active. If you can manage to do this on a daily basis, the better it will be for you. At least, you won’t have to worry when you face a dry spell in your regular budget.

What you need is to take your finances more seriously than ever before. It is never a guarantee that everything you buy will save up something for you to hold on to. Do your part and be disciplined in your spending.

Live Within Your Means

Buying items that are way beyond your regular budget is definitely a way of crippling your financial goals. All the more reason for you to live within your means. This way, you will avoid stress-related diseases and other complications. You will also be able to protect your credit score.

There is nothing difficult about this especially when you set your mind to doing the right thing. Avoid comparing yourself with others but rather, focus on what you can do instead. With time, you will find this more relaxing and calming than trying to keep up with people who are of higher social standing than you. When the time comes, you will also have a chance at what it feels like to lead that kind of life. In the meantime, only follow what you can.

Save More

Don’t spend just to clear off the few pennies and quarters that are left in your purse/wallet. The wisest thing for you to do would be to save them up as they will come in handy in the long run. Before you know it, you can afford something that you never thought you would before. All because you put together all the loose change that you thought was insignificant.

Don’t spend just to clear off the few pennies and quarters that are left in your purse/wallet. The wisest thing for you to do would be to save them up as they will come in handy in the long run. Before you know it, you can afford something that you never thought you would before. All because you put together all the loose change that you thought was insignificant.

This may seem tough at first but it will become easier in the long run. Once you make it a habit, you won’t have to feel too overwhelmed every time you have to get to this phase. It will be a delight before you know it.…

Five Hints to Improve Your Credit Score

In the era we live in today, you will be so lucky to land a job that pays you well. The ugly truth is that a huge fraction of the jobs that are up for grabs are great, but don’t pay so well. If you settle for one of them, then your odds of struggling financially and living from paycheck to paycheck are extremely high.

When you are in a challenging income bracket, your credit score becomes the victim in numerous occasions, which means that getting funding can be tough.

The pointers as presented below are for improving your credit score even when your income is low:

Know Your Score

The first step that you should take is to check your employer’s report knowing your score. Afterwards, you will start to work on the strategies to improve it. Besides, you should also be aware of your score as it can hinder you from doing business.

Avoid Making Late Payments

Not everyone like the idea of making payments every time. However, you should try as much as possible to stay away from making delayed payments on your credit cards.

Most people are not aware that their payment history decides almost a third of their overall score and is critical. If you wish to enhance your credit score, but have more debt than you can pay, you should contact your creditors to change your payment dates to immediately as soon as your salary lands in your account.

Ensure that those deductions are made before you spend a single cent. If you don’t, then you might end up spending the money on transport, food, rent, as well as other requirements.

Make Payment Reminders

Credit card payments play a vital role in determining your overall credit score. For this reason, you should set weekly or monthly reminders on your phone calendar to be on the safe side. Make sure that the reminder pops up three or four days before your payments are due and let it repeat until you are done with making the payments.

Don’t forget to put other bills on the reminder too. Avoid paying your rent late as well as utilities because they might show up on your credit score. If possible, ensure that you make these official payments two or three days in advance.

Don’t Close Old Accounts

If you wish to improve your credit score quickly, avoid eliminating old accounts as well as credit cards. The truth of the matter is that keeping your accounts active will assist you when it comes to building a positive credit score.

You can destroy the cards to avoid the temptation to use them unnecessarily. Keep repeating the process every time you get a new one.

File Accounts on Time

If you run a small business, then you should always ensure that you file your accounts before the deadline. The key reason is that the accounts might need extra time for processing, and filing them late might earn you a fine. If your accounts tell a good story, then lenders are more likely to give you the credit that you need.…